Coin Grading Basics

How Does One Begin Coin Grading? The purpose of this article is to give you enough information so that you can have an idea how

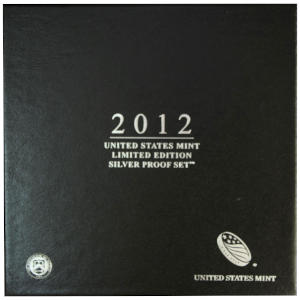

Here-in lies one of those mysteries that we come across sometimes in coin collecting. Once in a while, the mintage numbers for a coin for a certain year in comparison to the price that that coin is being sold at just does not add up. The most recent time this happened was in 2012. This always causes us coin enthusiasts to scratch our heads in wonderment, and to try to predict when it will happen again so that we can be prepared for it.

Here-in lies one of those mysteries that we come across sometimes in coin collecting. Once in a while, the mintage numbers for a coin for a certain year in comparison to the price that that coin is being sold at just does not add up. The most recent time this happened was in 2012. This always causes us coin enthusiasts to scratch our heads in wonderment, and to try to predict when it will happen again so that we can be prepared for it.

The 2012 mintage numbers for the 2012 proof coins was actually right smack dab in the same range as the mintage numbers for the year 2013 and the year 2014 both. However the cost for the 2012 proof coin set is substantially higher than the costs for the 2013 and 2014 sets. Why?

Let’s look at the numbers at work here:

2012 proof mintage numbers was right at 395,443

2013 proof mintage numbers was right at 419,720

2014 proof mintage numbers was right at 404,665

And for the clad mintage numbers:

2012 clad mintage numbers was right at 794,002

2013 clad mintage numbers was right at 802,460

2014 clad mintage numbers was right at 680,977

Here’s what I think happened that caused the prices to skyrocket for the 2012 coins, and for a dip to occur for the prices of the 2013 and the 2014 sets. The United States Mint ended their sales for 2012 sets in early 2013 which strange because they usually run the sales of each set for an extra year. So, most coins get two years of sales from the U.S. Mint before the Mint stops selling them. Once the Mint stops selling them then that’s it, no more sets. So, for some reason the Mint stopped selling the 2012 set about nine months earlier than most sets. This caused the demand for the sets to jump up, which also exploded the price of the sets.

Conversely, major coin dealers and whole sale companies started gobbling up 2013 and 2014 sets, thinking that the Mint was going to do the same thing with the 2013 and 2014 sets that they did with the 2012 sets.

But they didn’t.

The United States Mint ran the 2013 and 2014 sets for the usual, typical, and totally predictable time period of two years. Now there was a surplus of the 2013 and the 2014 sets for sale, and the price for these sets dropped substantially.

It wasn’t just coin dealers and wholesalers. Dealers had to have the 2012 sets so they paid more for them. This led to bidding wars. The price went up. Now the 2012 set was almost unaffordable for the average collector. To try to get with the program, over the next two years big dealers stocked up on 2013 and 2014s. However, going back to their usual operating basis, the U.S. Mint kept offering the 2013 and 2014 sets and it created a surplus. The price of the 2012 sets never came down either.

It wasn’t just coin dealers and wholesalers. Dealers had to have the 2012 sets so they paid more for them. This led to bidding wars. The price went up. Now the 2012 set was almost unaffordable for the average collector. To try to get with the program, over the next two years big dealers stocked up on 2013 and 2014s. However, going back to their usual operating basis, the U.S. Mint kept offering the 2013 and 2014 sets and it created a surplus. The price of the 2012 sets never came down either.

This isn’t the first time we’ve seen this happen, and it always dare I say it, frustrates us as we have no way of knowing when the Mint will pull a fast one and do something like this. The U.S. Mint did this in 2008 and 1997. Something similar happened in 1999 too. In fact in 1999 the proof set peaked at six-hundred dollars a set!

People are always asking how to predict this and how to prepare for things like this, so that they can buy the sets when they are cheap and then sell them when they are expensive. Unfortunately there really is no way of knowing when this sort of thing will happen. It’s a crystal ball type of situation that requires fortune telling skills to predict. Because the trends that cause these price surges to occur are not normal nor are they predictable, we in the coin collecting field really have no way of telling when these sorts of things will happen again. But that’s part of what makes the hobby a hobby, and part of what makes coin collecting a fun activity and a passion for many of us to engage ourselves in.

How Does One Begin Coin Grading? The purpose of this article is to give you enough information so that you can have an idea how

In 1878 the first Morgan dollar coins were struck. These are some of the most prized coins among coin collectors. There were several varieties of

As both a coin dealer and a collector myself, I have had many experiences with improperly stored coins. Many times I have received a delivery

The easiest way to get in contact with us is by filling out the form and submitting it.

We will contact you as soon as we can.

David Enders

PO Box 508

Athens MI 49011

The Dave’s Collectible Coins customer service goal is simple:

We are committed to providing our customers total satisfaction. Every time. Guaranteed.

For non-urgent matters please use the form in this popup. For urgent matters please call 269-742-4716.

Customer service is available Monday – Friday 8:00am – 4:30pm EST